What is RFM analysis?

- Author: Nishant Pathak

- Published On: 15/05/2024

- Category: Research

Introduction

What is RFM?

RFM analysis is a powerful marketing technique used by businesses to segment and target customers based on their transaction history. RFM Analysis stands for Recency, Frequency, and Monetary Analysis. These are the three key metrics used to evaluate customer behavior. Businesses can gain valuable insights into customer preferences and purchasing patterns by analyzing these metrics, allowing them to tailor marketing strategies for maximum effectiveness.

Who created this technique?

The RFM analysis technique was popularized in the 1960s by marketers seeking a more systematic approach to customer segmentation. While its exact origins are unclear, it is often attributed to the direct marketing industry. Companies sought to identify and target their most valuable customers. Over the years, RFM analysis has evolved into a widely used methodology across various industries, helping businesses optimize their marketing efforts and drive revenue growth.

What are the Key Benefits of using RFM?

Enhanced Customer Segmentation

RFM analysis enables businesses to categorize customers into distinct segments based on their buying behavior. By segmenting customers according to recency, frequency, and monetary value, businesses can identify high-value segments and tailor marketing strategies to meet their specific needs.

Get your FREE Marketing Automation Cheat Sheet!

Unlock the power of marketing automation with our comprehensive cheat sheet, designed to streamline your marketing efforts and drive results.

Targeted Marketing Campaigns

With RFM analysis, businesses can create targeted marketing campaigns designed to resonate with different customer segments. By understanding the recency, frequency, and monetary value of each customer, businesses can deliver personalized messages and offers that are more likely to drive engagement and conversions. These campaigns can be manually designed or on your marketing platform.

Improved Customer Retention

By identifying and prioritizing high-value customers through RFM analysis, businesses can focus their efforts on retaining these valuable relationships. By offering incentives, rewards, and personalized experiences to loyal customers, businesses can increase customer satisfaction and loyalty, leading to long-term revenue growth.

Efficient Resource Allocation

RFM analysis helps businesses allocate their resources more efficiently by focusing on customers with the highest potential for profitability. By identifying and targeting high-value segments, businesses can optimize their marketing spend and maximize return on investment.

Data-Driven Decision Making

By leveraging data from RFM analysis, businesses can make informed decisions about product offerings, pricing strategies, and marketing tactics. By using data-driven insights to guide decision-making, businesses can stay ahead of the competition and adapt to changing market dynamics.

Recency, Frequency, and Monetary

Recency

Recency refers to how recently a customer has made a purchase or interacted with the business. In RFM analysis, recency is typically measured in days, weeks, or months, depending on the industry and business model. Customers who have made a purchase or engaged with the business recently are considered more valuable and are more likely to respond to marketing efforts.

Frequency

Frequency measures how often a customer has made purchases or interacted with the business over a specific period of time. Customers who make frequent purchases or engagements are often more loyal and valuable to the business. By analyzing frequency data, businesses can identify their most loyal customers and tailor marketing strategies to retain their loyalty.

Monetary

Monetary value represents the total amount of money a customer has spent with the business over a specific period of time. Customers who spend more money are typically considered more valuable to the business and may receive special treatment or rewards. By analyzing monetary data, businesses can identify their highest-spending customers and prioritize them in marketing efforts.

How does RFM Analysis Work?

Like any other process, RFM analysis also begins with collecting data. It goes without saying how important data is for marketing. After the data of the customers is collected the following steps are undertaken to conduct an RFM Analysis.

1. RFM Rating

RFM analysis involves assigning numerical scores to each customer based on their recency, frequency, and monetary value. These scores are typically on a scale of 1 to 5, with 5 being the highest and most desirable score. Once scores are assigned, customers are segmented into different groups based on their RFM ratings.

2. Segmenting Customers

Once customers have been assigned RFM scores, they can be segmented into different groups based on their scores. Common segmentation approaches include dividing customers into high-value, medium-value, and low-value segments, or grouping them based on specific RFM combinations (e.g., high recency, low frequency).

3. Creating Strategies for Each Customer Segment

Once customers have been segmented, businesses can create targeted marketing strategies for each segment. These strategies may include personalized messaging, special offers, and incentives designed to resonate with the unique needs and preferences of each segment. By tailoring marketing strategies to specific customer segments, businesses can increase engagement, loyalty, and revenue.

RFM Analysis in Action

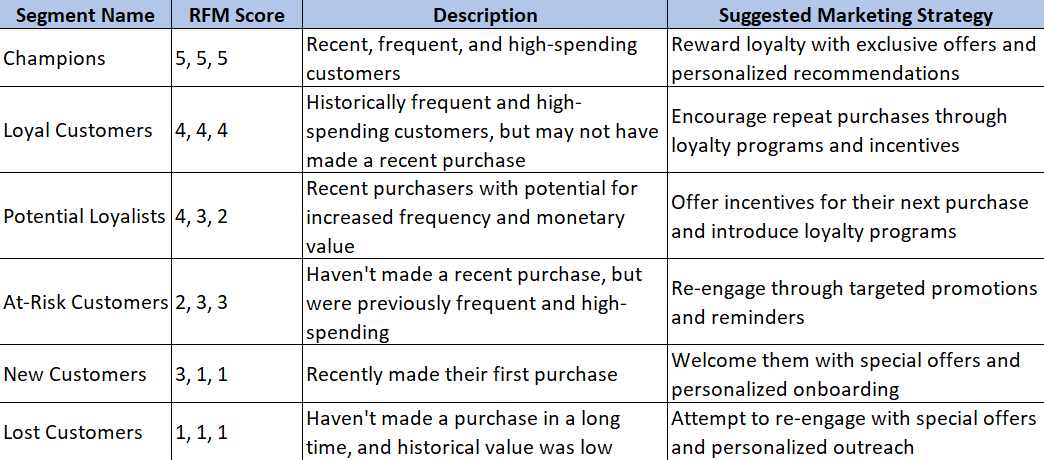

One can find out scores of their customers after conducting the first step of their RFM Analysis and segments them together as given in the following table.

After creating segments and understanding the status of each of them, you finish up the RFM Analysis by developing marketing strategies for approaching each of the segments.

Limitations of RFM Analysis

While RFM analysis is a valuable tool for customer segmentation and targeting, it does have some limitations. These limitations are:

Lack of Contextual Information

RFM analysis relies solely on transactional data, such as purchase frequency and monetary value, to segment customers. However, it does not take into account contextual information, such as customer demographics, psychographics, or behavioral patterns outside of purchase history. This limitation can result in oversimplified customer segmentation and may overlook important factors influencing customer behavior.

For example, two customers with identical RFM scores may have different preferences, motivations, and shopping habits. Without contextual information, businesses may struggle to understand why certain customers exhibit specific behaviors or how to effectively engage with them.

Limited Predictive Power

RFM analysis is primarily retrospective in nature, focusing on past customer behavior to identify segments and inform marketing strategies. While RFM scores provide valuable insights into historical customer interactions, they may not accurately predict future behavior or account for changes in customer preferences over time. It is thus important to have dynamic audience prediction for your marketing efforts.

For instance, a customer who was previously classified as high-value based on RFM scores may shift to a lower-value segment due to changes in their purchasing behavior or market dynamics. Without considering dynamic factors and external influences, businesses may overlook opportunities to adapt their marketing strategies and effectively engage with customers.

Inability to Capture Non-Monetary Interactions

RFM analysis primarily focuses on monetary transactions, such as purchases or order values, to evaluate customer behavior and determine segmentations. However, it fails to capture non-monetary interactions, such as website visits, email opens, or social media engagement, which are increasingly important indicators of customer engagement and loyalty in the digital age.

For example, a customer who frequently engages with a brand's content on social media or regularly visits their website may demonstrate high levels of interest and brand affinity, despite not making frequent purchases. Without considering these non-monetary interactions, RFM analysis overlooks valuable opportunities to nurture relationships with customers and drive long-term engagement.

Get your FREE Marketing Automation Cheat Sheet!

Unlock the power of marketing automation with our comprehensive cheat sheet, designed to streamline your marketing efforts and drive results.

Alternate Versions of RFM

As businesses navigate the complexities of modern markets, the limitations of traditional RFM analysis have become increasingly apparent. While RFM analysis provides valuable insights into customer behavior and segmentation, it often falls short of capturing the full spectrum of customer interactions and preferences.

In response to these challenges, alternative versions of RFM analysis have emerged, offering enhanced frameworks for understanding and engaging with customers

RFE (Recency, Frequency, Engagement)

In addition to RFM analysis, online businesses may use a variation known as RFE analysis, which includes an additional metric: engagement. Engagement measures how actively a customer interacts with the business, such as by visiting the website, opening emails, or engaging with social media content. By incorporating engagement data into the analysis, online businesses can gain deeper insights into customer behavior and tailor marketing strategies accordingly.

RFV (Recency, Frequency, Value)

RFV analysis is a variation of RFM that focuses on recency, frequency, and value. In addition to measuring the monetary value of customer transactions, RFV analysis considers other metrics related to customer value, such as average order value, total lifetime value, and customer profitability. By incorporating these additional metrics into the analysis, businesses can gain a more comprehensive understanding of customer value and prioritize their marketing efforts accordingly.

RFM-P (Recency, Frequency, Monetary, Product)

RFM-P analysis extends the traditional RFM framework by incorporating product-specific data into the analysis. In addition to evaluating recency, frequency, and monetary value, RFM-P analysis considers factors such as product category, purchase history, and product preferences. By segmenting customers based on both transactional data and product-related metrics, businesses can create targeted marketing campaigns that are tailored to the unique needs and preferences of each customer segment.

Conclusion

In conclusion, RFM analysis is a powerful marketing technique that enables businesses to segment and target customers based on their transaction history. By analyzing recency, frequency, and monetary value, companies can gain valuable insights into customer behavior and preferences, allowing them to create targeted marketing campaigns that drive engagement, loyalty, and revenue.

While RFM analysis has its limitations, it remains a valuable tool for businesses seeking to optimize their marketing efforts and enhance customer relationships in an increasingly competitive marketplace.